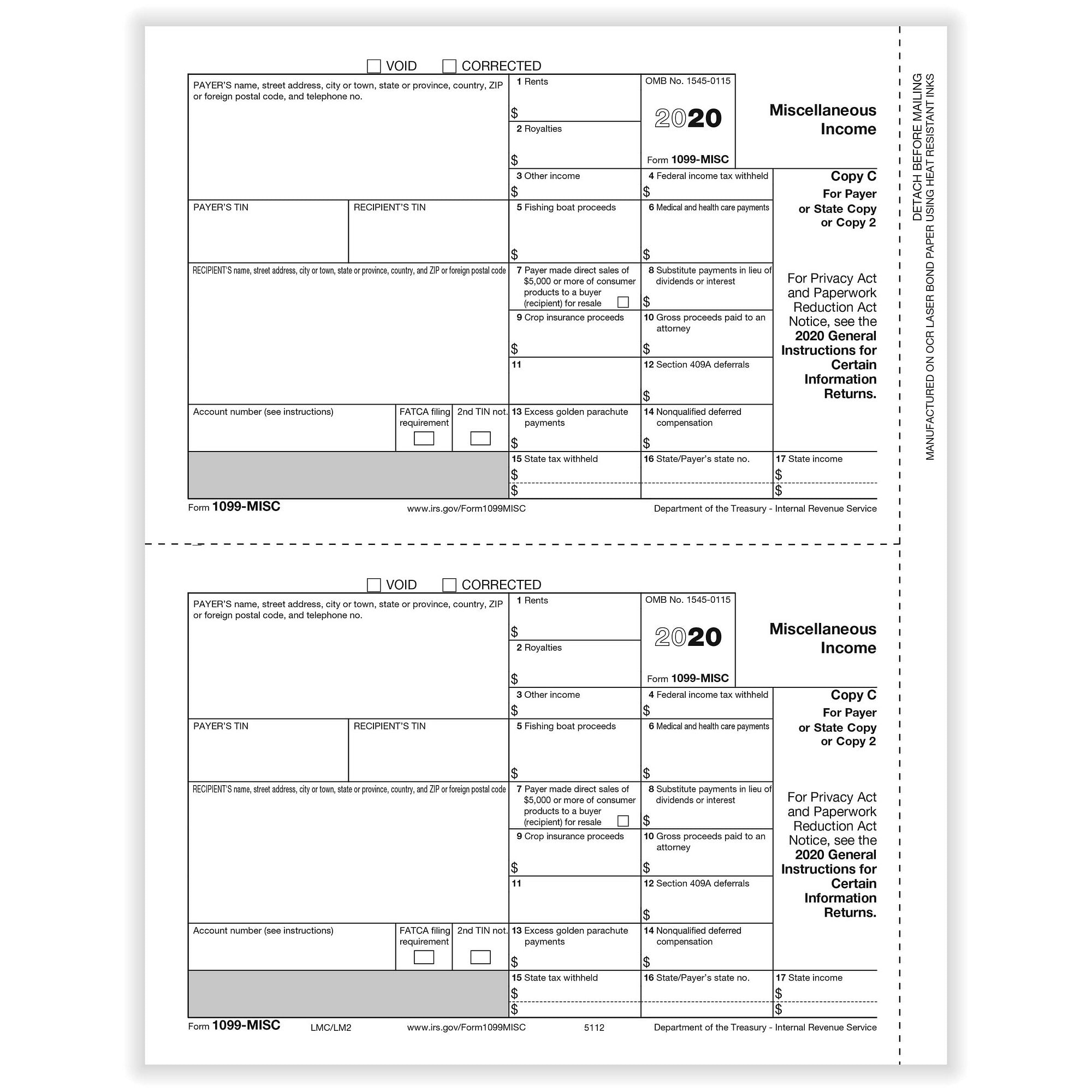

The deadline for a 1099MISC (with an amount in box 7) is January 31st, and is the deadline for both efiling and paperfiling Even if you missed the deadline, you should still be able to efile it 0Does it get sent to your state tax dept or your receiptants state tax department?Mail form 1096 and Copy A of each 1099 form to the IRS Maryland taxpayers must mail copies to Department of Treasury Internal Revenue Service Center Kansas City, MO Step 5 Give or mail Copy 1, Copy 2 and Copy B to the subcontractor listed on the respective 1099 form Keep Copy C for your records

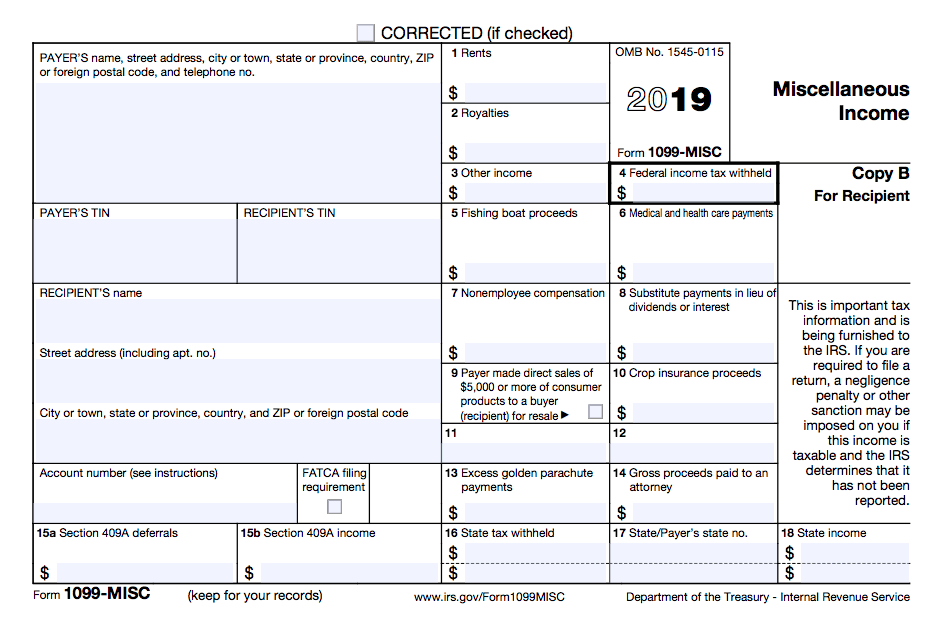

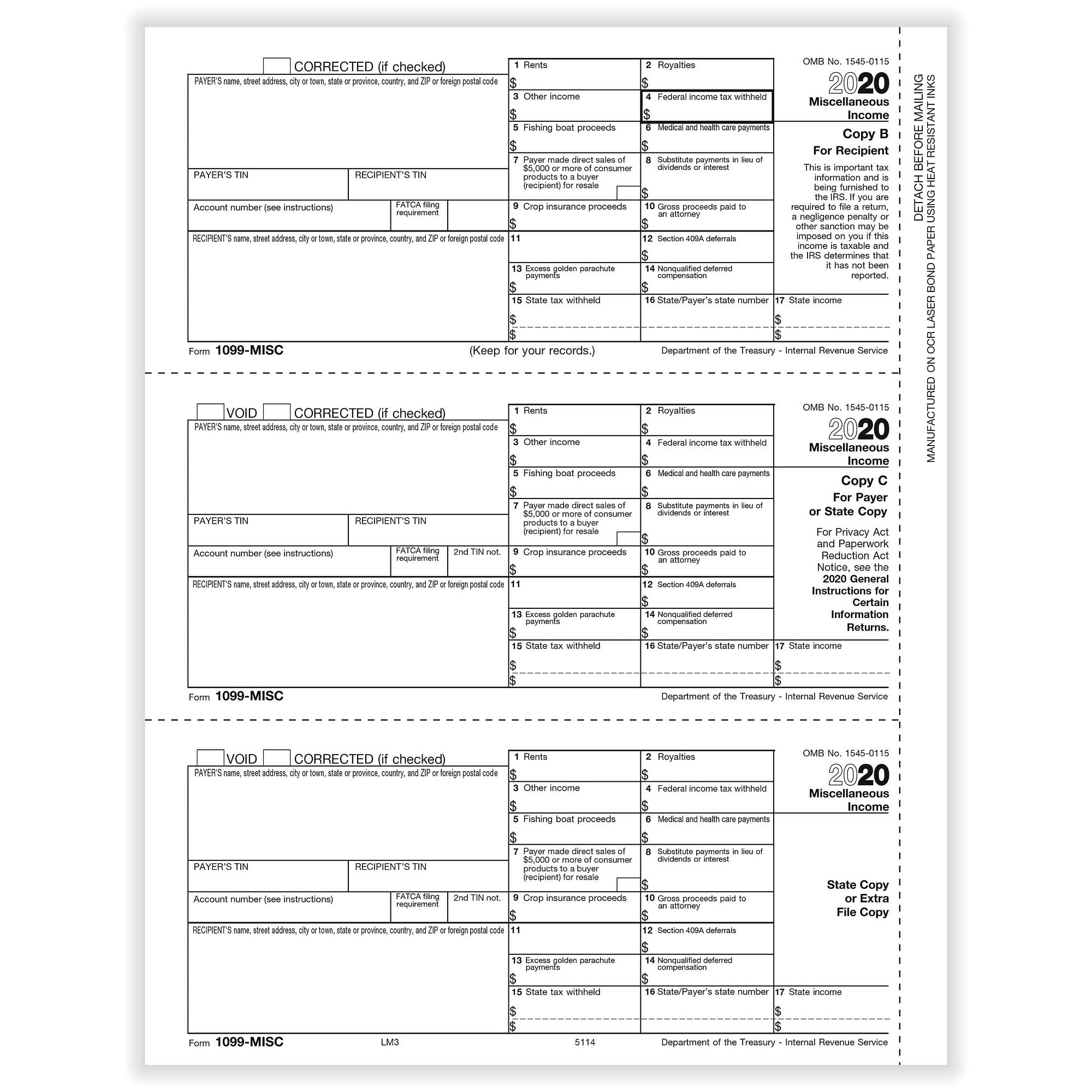

Form 1099 Misc Miscellaneous Income

1099 copy 1 for state tax department

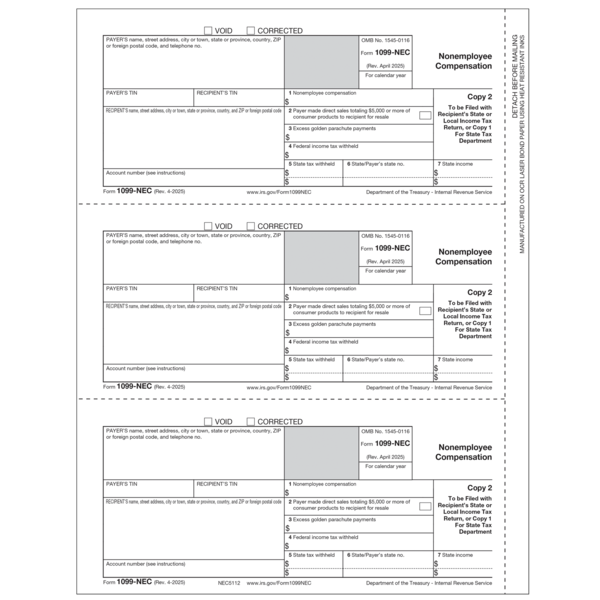

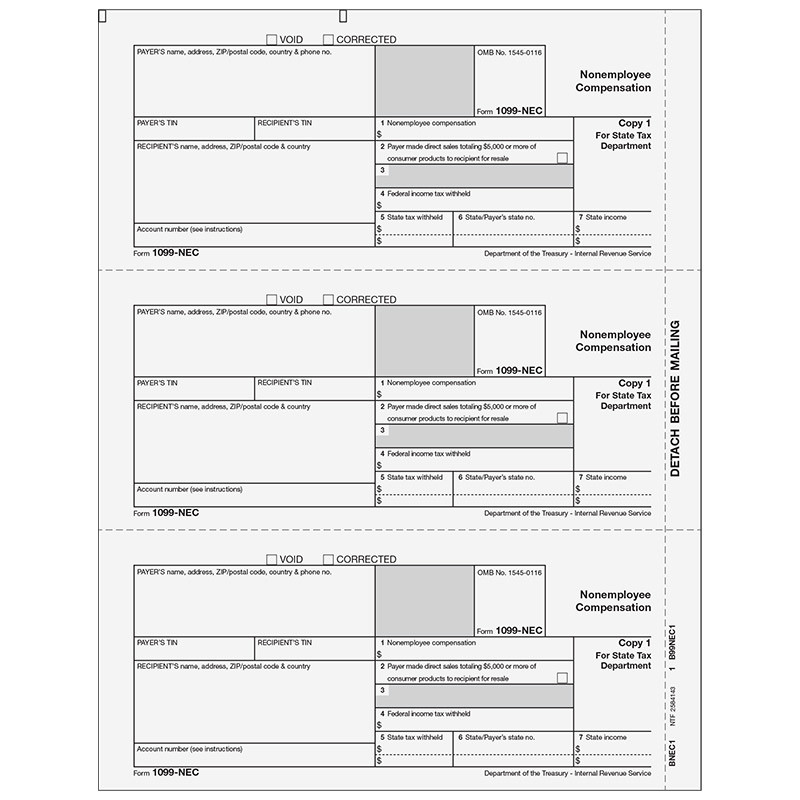

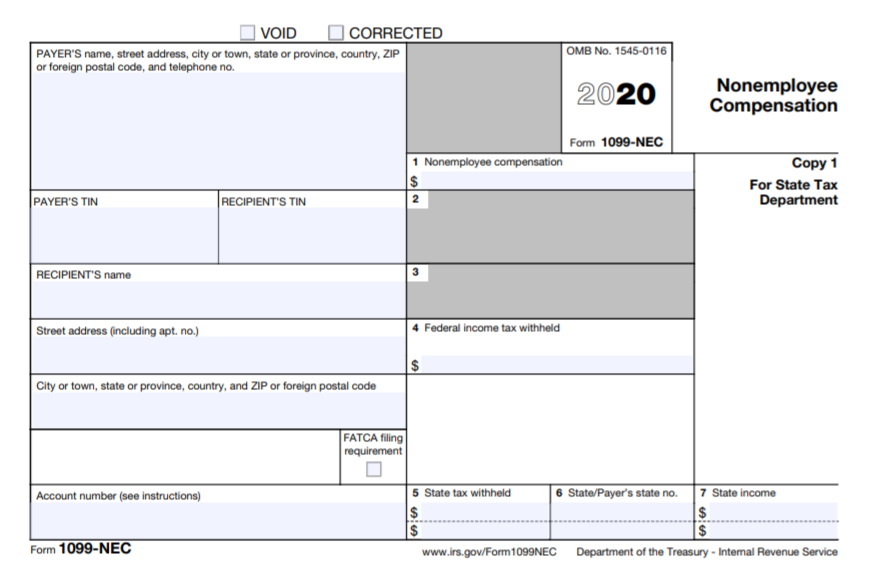

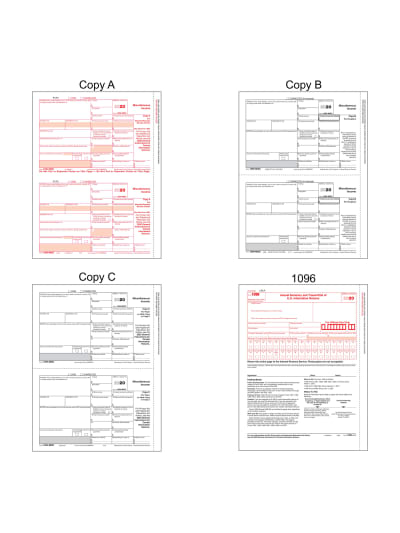

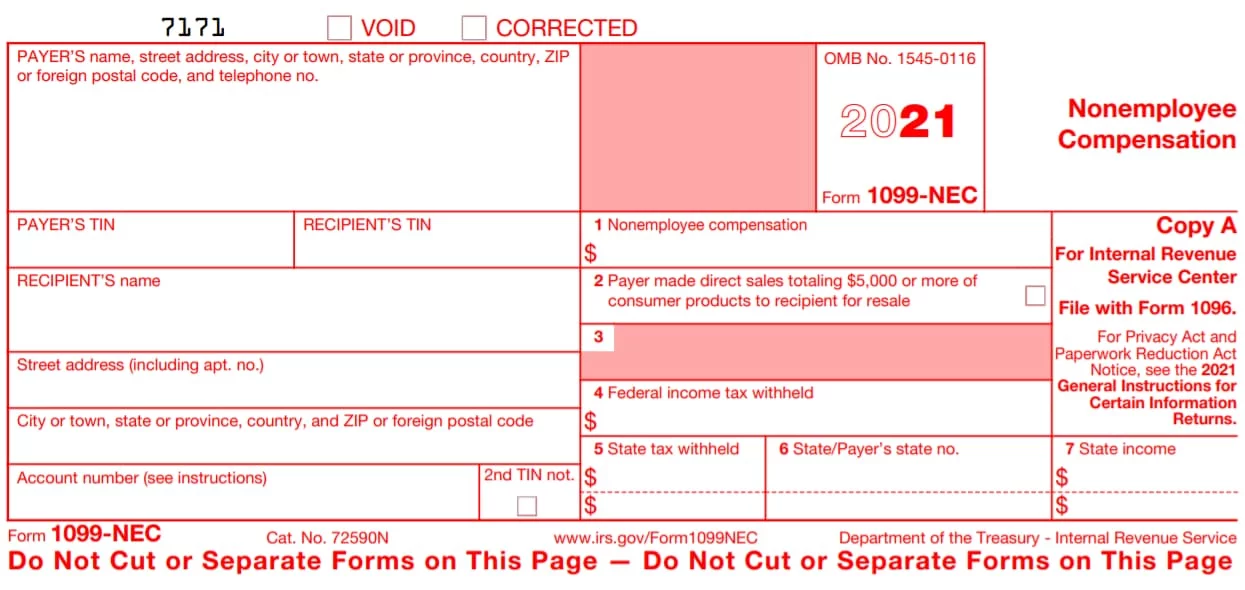

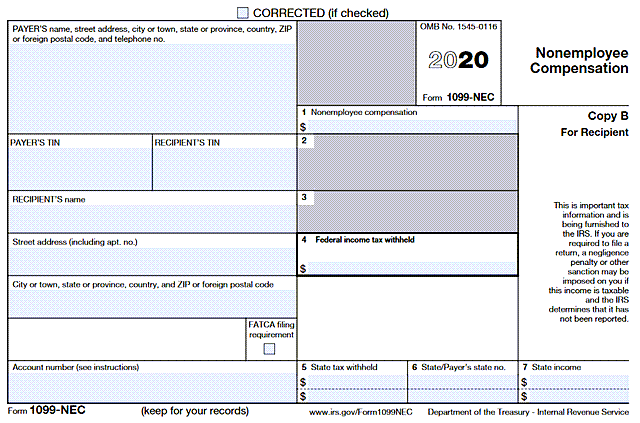

1099 copy 1 for state tax department-The 1099NEC is a multipart form that is handled as follows Copy A — File with IRS by the paper or electronicfiling deadline Copy 1/State Copy — File with the appropriate state taxing authority, if applicable Copy B — Distribute this copy to individuals, Payers who made at least $600 as miscellaneous payments must file Form 1099MISC It is also important to send copies of the form to the recipients before the deadline

1099 Misc Form Fillable Printable Download Free Instructions

Step 3 Provide copies to your contractors 1099NEC and 1099MISC forms must be postmarked to contractors by For details on which forms to file and due dates see Form 1099NEC and Form 1099MISC With the new Form 1099NEC being brought into the mix, Form 1099MISC has a new deadline If you plan on using the paper form, File Form 1099MISC by Form 1099MISC has a due date of if you file electronically Send Copy B of Form 1099MISC to the recipient no later than1099 copy 1 how do i file 1099 misc copy 1 nancy 1099 Filing Depending on which state you live in you must mail 1099 Copy 1 to the State Tax Department For specific information regarding this contact your State Tax Department

As a small business owner, please verify if we should mail As a small business owner, please verify if we should mail both copies of Form 1099Misc (Copy b) and (Copy 1 for State Tax) to the recipient We have Form 1096 and Copy C of the Form 1099 ready to ma read more Ed Johnson Senior HR Consultant and Business DevlpmObtain a blank 1099 form (which is printed on special paper) from the IRS or an office supply store Fill out the 1099 Each Form 1099 comes with 5 copies, so make sure to write or type on the top copy so it transfers down onto each copy, like carbon paper Send Copy A to the IRS, Copy 1 to the appropriate state tax agency, Copy B and Copy 2 to1099MISC Miscellaneous Income Federal Copy A 2up $1000 SKU LMA Miscellaneous Income 1099MISC 2up Federal Copy A form Order the quantity equal to the number of recipients for which you file Plus FREE SHIPPING to the continental 48 states IMPORTANT You may need to use the new 1099NEC form with or instead of the 1099MISC

The 1099MISC has Copy A, B, C, 1 and 2 Copy A is sent to the IRS along with the 1096 Copy B is sent to the recipient and the recipient keeps that copy The payer or the business issues the 1099MISC forms to vendors/contractors should retain Copy C Form 1099MISC, Miscellaneous Income, is an information return businesses use to report payments (eg, rents and royalties) and miscellaneous income File Form 1099MISC for each person you have given the following types of payments to during the tax year At least $10 in royalties or broker payments in lieu of dividends or taxexempt interestDoes it get sent to your state tax dept or your receiptants state tax department?

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Copy 1 This part is sent to the state tax department by the taxpayer Copy B The taxpayer receives this (Before January 31 st) Copy 2 For the purpose of filing with the state tax return, this copy is sent to the recipient Copy C The final copy is kept by the taxpayer Where to Get 1099 On the tax form 1099 misc there is a copy c,copy 1,copy 2,i just started my business and i need to figure out which Answered by a verified Tax Professional We use cookies to give you the best possible experience on our websiteEfile Payroll and Employment Tax Forms 941, 1099, W2, 940 and 1095 Pricing Starts as low as $050/form We distribute employee/recipient copies by postal mail

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

What Is 1099 Misc Form How To File It Complete Guide

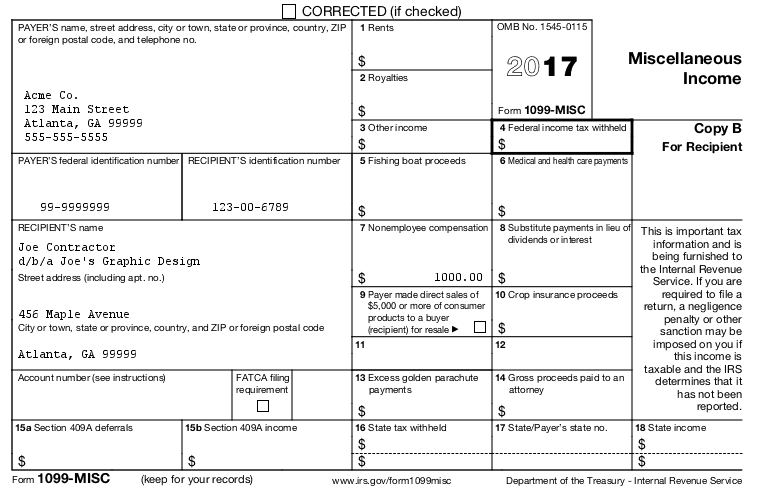

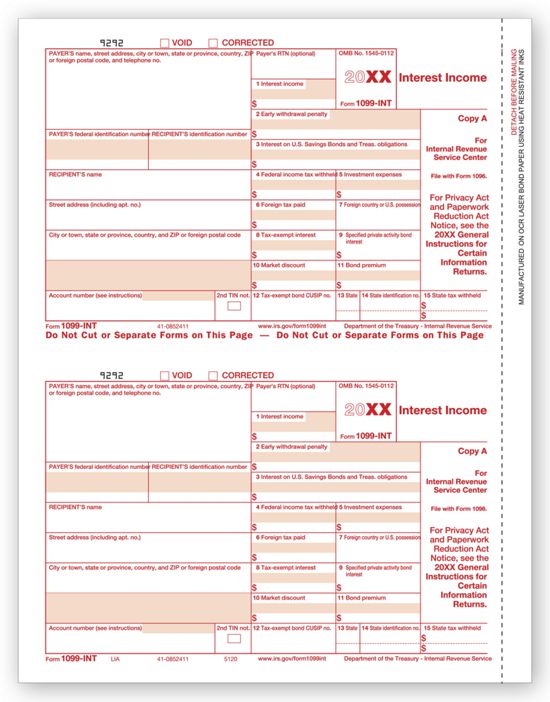

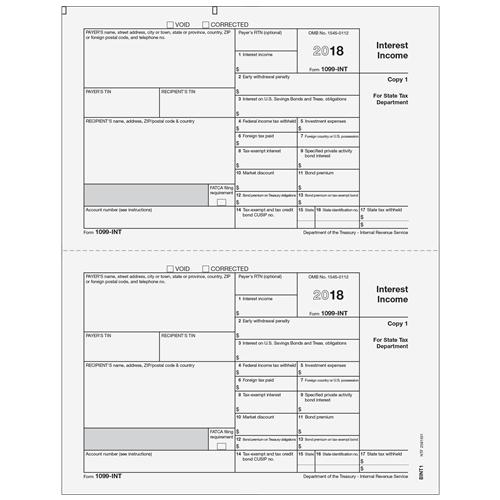

The 1099MISC Form generally includes 1 Your name, address and taxpayer ID number 2 The name, address and taxpayer ID number of the company or individual who issued the form 3 The amount of income paid to you during the year in the appropriate box, based on the type of income you received 4 The burden on businesses seems to grow each year Even cost basis is now required on some Forms 1099 But the real prize is receiving them Since the IRS gets a copy16 or more $598 Use Form 1099INT to report interest of $1000 or more, taxable or nontaxable, and to report any federal or foreign income tax withheld and not refunded, paid in the course of your trade or business This copy is for the State 2 Forms per page Price is for a package of 25 pages = 50 Recipients

1099 Misc Payer Copy C

Nec5112b

1099R Form Copy D1 for Payer State and File 1099R Forms for Taxes Withheld on Distributions from Pensions, Annuities, Retirement or ProfitSharing Plans, IRAs, Insurance Contracts, Etc Order a quantity equal to the number of recipients you haveBuy 300 for $010 each and save 59% A 1099MISC is a form used by businesses to report miscellaneous taxable payments to many different kinds of payees Beginning with reports for the tax year, you can't use the 1099MISC form for payments you make to nonemployees ( independent contractors, attorneys, and others who provide services to your business)

1099 Forms Printable 1099 Forms 21 Blank 1099

Laser 1099 Nec Payer State Copy 1 Sage Checks And Forms

How do i file 1099 misc copy 1 nancy 1099 Filing Depending on which state you live in you must mail 1099 Copy 1 to the State Tax Department For specific information regarding this contact your State Tax Department 1099 copy 1 1099 Filing 1099 misc copy 1 file 1099For many employers, all five copies of the 1099 form are essential Copy A—Goes to the IRS Copy 1—Goes to the state tax agency Copy 2—Goes to the recipient Copy B—Goes to the recipient Copy C—Stays with employer for record keepingForm 1099MISC 19 Cat No J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service

Laser 1099 Misc Forms Sage Checks And Forms

1099 Misc Miscellaneous Rec Copy B Payer State Copy C State Extra File Copy 500 Forms Ctn

Where is Copy A of the 1099MISC?Use the 1099MISC Copy C for Payer files Mail in envelope #RDWENV05 Use the 1099MISC Copy 1 to print and mail payment information to the State Mail as a batch to the state Use the 1099MISC Copy 2 to print and mail payment information to the recipient (payee) for submission with their state tax return Mail in envelope #RDWENV05 If you have to send the copy 1 of the 1099MISC to the state of Texas it would have to be to the state tax department in Texas

Q Tbn And9gcr A0xynxdhhxxfl7nxp1 Ksov2b3i1bqvj6yqi0itop9kghngk Usqp Cau

Irs 1099 R Tax Forms Department Of Retirement Systems

Where do you send 1099misc copy 1 08?If you have questions or need help understanding how to request your replacement SSA1099 or SSA1042S online, call our tollfree number at or visit your Social Security office If you are deaf or hard of hearing, call our tollfree TTY number, , between 800 am and 530 pm Monday through FridayThese include Forms 1099B, 1099DIV, 1099INT, 1099MISC, 1099OID, 1099R, and 5498 Each Item is a package of 25 envelopes Form 1099DIV Dividends and Distributions, IRS Copy

How Do You File 1099 Misc Wp1099

Tf5112b 2 Up 1099 Misc Laser Payer State Copy C Tax Forms In Bulk Packs

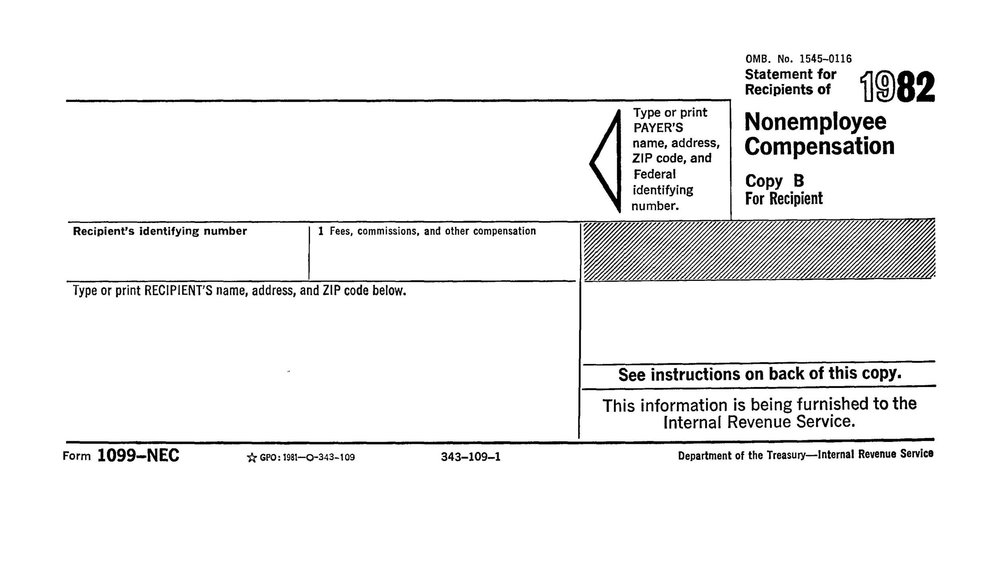

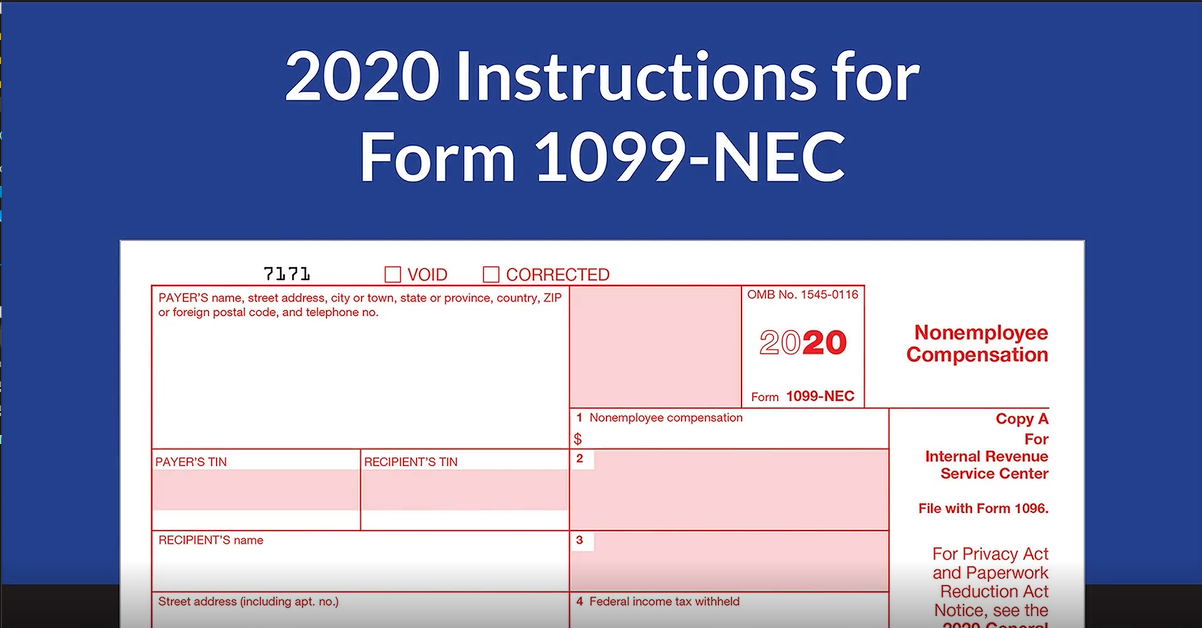

Form 1099NEC is reserved for individuals who provide you with services but who don't work for you as an employee It's also used for attorneys under some circumstances, and for anyone from whom you purchase fish or "other aquatic life," but only if you make the purchase with cash and the individual is someone whose business is catching fish Form 1099MISC is still in Is "1099MISC Copy 1" and "1096" sent to IRS with my EFiling or they need to be mailed to State Tax Department ?????Use the 1099MISC Payer State Copy 1 to print and mail payment information to the State Year * * Required Fields Buy 50 for $018 each and save 25% ;

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

1099 Misc Copy B Laser W 2taxforms Com

AtlantaTaxExpert Posts 21,818, Reputation 846 Senior Tax Expert , 0922 PM The RED copy goes to the IRS As long as the SSA, state, city and individual gets legible copies, it really doesCompile all the copy 1 forms and send them in one envelope to the state Here's the next form in the set It's called Copy B and goes to the 1099 vendor These also print 2 vendors per page and you should separate the forms and mail to the vendor along with Copy 2 in the same envelopeP (Taxable in a prior year of the 1099R year – the year the refunded contribution was made) *Nonqualified Roth Distribution (less than 5 years) – use code B and complete Box 11 (Roth clock start), the principal Roth contribution amount in Box 10, and the taxable amount in Box 2A DWC Notes All hardships under the age of 59 1/2 must use

Choosing 1099 Box Types 1099 Nec And 1099 Misc

Tax Form 1099 R Copy D 1 Payer State 5143 Form Center

Buy 100 for $011 each and save 55% ;Or sales@realtaxtoolscom Laser 1099 Forms are used by businesses, accountants and 1099 service providers to prepare 1099's for sending to vendors and the government (federal, stateOfficial 1099R Forms Use the 1099R Payer or State Copy 1/D to print and mail payment information to the State (if required) or for payer files

Prepare To Issue New Irs Form 1099 Nec By Jan 31 21 Ohio Cpa Firm Rea Cpa

1099 Laser Misc Federal Copy A Item 5110

It is filing season and your clients may be asking you where to send the "state copy" of an information return, such as a W2 for an employee and a 1099 to other payees If your client filed paper returns with IRS, they do not need to send a paper copy to us IRS will forward the information to us, whether they are located in or out of These 1099 forms might require you to submit Copy 1 to the State tax department If you have a cancellation of your debt, you might need to file Copy 1 of your 1099C with your State tax department This cancelled debt might be taxable income The 1099G is used by governmental agencies to report their State income tax refunds and unemployment 1099 Misc copy 1 Where do you send 1099misc copy 1 08?

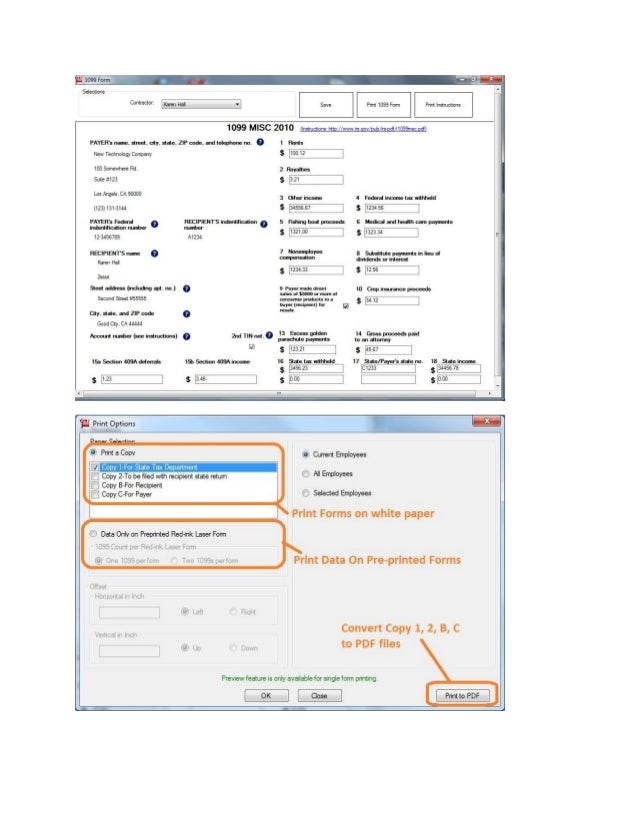

How To Print 1099 Form

Startchurch Blog Updates You Must Know 1099 Misc 1099 Nec

The 1099MISC is a multipart form that is handled as follows Copy A — File with IRS by the paper or electronicfiling deadline Copy 1/State Copy — File with the appropriate state taxing authority, if applicable Copy B — Distribute this copy to individuals,(1) 1099MISC Form Copy A (Red ink, 2Up) (2) 1099MISC Form Copy B (Black ink, 2Up) (3) 1099MISC Form Copy C (Black ink, 2Up) Need helping choosing the right forms?Home » Others » 1099 Form Copy 1 For State Tax Department » Form 1099 MISC Miscellaneous Income State Copy 1 Form 1099 MISC Miscellaneous Income State Copy 1 By Loha Leffon Published Full size is 800 × 1035 pixels

21 Quickbooks 1099 Nec 4 Part Pre Printed Tax Forms With Envelopes

Tops 1099 Continuous Miscellaneous Forms 5 Partcarbonless Copy 5 1 2 X 8 Sheet Size White

What to do with each of the copies of Form 1099MISC, including Copy A, Copy B, Copy C, and Copies 1 and 2 Form 1099MISC Copies of the form Our 1099 EFile service steps you through creating, printing or emailing, and efiling copies of Form 1099MISC required byIf you entered the information from the 1099 into Turbo Tax, that information will be transmitted in the efile If any forms need to be printed and mailed separately, it will prompt you and give you instructions IRS Form 1099A is an informational statement that reports foreclosure on property Homeowners will typically receive an IRS Form 1099A from their lender after their home has been foreclosed upon, and the IRS receives a copy as well The information on the 1099A is necessary to report the transaction on your tax return

Tax Form 1099 Div Copy C 1 Payer State 5132 Form Center

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

For recipient copies, the mail must be postmarked by the due date It would help if you also considered eDelivery for providing recipient copies electronically It is a convenient way to provide recipients their copies electronically instead of mailing Consider filing early and not wait for the due date for filing 1099s A You are required to send the 1099 copies only when you paper file However, when you file 250 or more 1099s, you must file them electronically Regardless of the form volume, efiling is the most preferred method because you can submit multiple 1099s at once without hassle If you still want to paper file 1099s, attach 1096 & G1003 and sendF1 (w2), cpt (1099 misc), opt (1099 misc) 3 Answers Hi, I am f1 student from india I was working in my school in Louisiana on w2 from January 07 to may 07 and my gross earning was $40 ( net pay $, state

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

1099 Nec Form Copy C 2 Zbp Forms

Stuff the 1099 recipient copies inside 1099 envelopes and send to the recipients by the 1099 due date Also send forms 1099 Copy A along with form 1096 to the IRS by the due Step 19 Make sure you are not printing and sending more than 255 1099 forms, inFollow Some states require you to send them a copy of the 1099 forms you filed with the IRS Other states don't require you to send a copy because they participate in the Combined Federal/State Filing Program (CF/SF) The CF/SF Program was created to simplify information returns filing Through the CF/SF Program, the IRS electronically

1099 Misc Form 1 Part E Filing Carbonless Form Discount Tax Forms

Tf5143b Laser 1099 R Copy D Bulk 8 1 2 X 11

All W3 Forms

E File Form 1099 Misc Online How To File 1099 Misc For

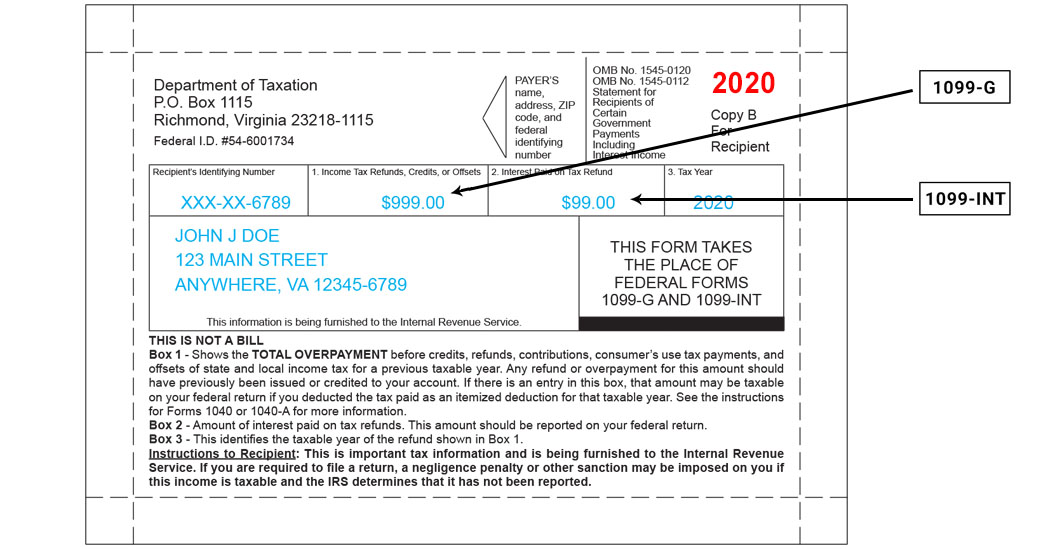

Your 1099 G 1099 Int What You Need To Know Virginia Tax

1099nec Tax Form Copy A For Federal Irs Filing Zbp Forms

1099 Misc State Copy 1 Laser Forms

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

Form 1099 Misc Miscellaneous Income

1

What Is Form 1099 Nec

1099 R Payer State Copy D 1

What Is The 1099 Form For Small Businesses A Quick Guide

Form 1099 Misc To Report Miscellaneous Income

W 9 Vs 1099 Irs Forms Differences And When To Use Them

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

1099 Misc Form Fillable Printable Download Free Instructions

1099 R Form Copy D 1 Payer State Zbp Forms

3

1099 Misc Miscellaneous Income Payer State Copy 1 2up

1099 R Form Copy D 1 Payer State Discount Tax Forms

What Does The Revived Form 1099 Nec Entail For Taxpayers In Initor Global

1099 Misc Laser Federal Copy A

Year End 1099 Misc State Copy 1 Forms P

Formsandchecks Help Page State List W 2 And 1099 Forms

Amazon Com Irs Approved 1099 Misc Copy A Bulk Discount Tax Form 1 Carton Office Products

Office Depot

Bnec105 1099 Nec 2up Payer State Copy 1 Greatland Com

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

1099 Misc Form Reporting Requirements Chicago Accounting Company

Tf5111 Laser 1099 Miscellaneous Income Recipient Copy B 8 1 2 X 11

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Misc Miscellaneous Income Payer State Copy 1

1099 S Form Copy A Federal Discount Tax Forms

State And Federal Deadlines And Important Reminders For Filing 1099 Forms

1099 R Distributions From Retirement Accounts Payer Or State City Local Copy 1 D 2up

1099 Laser Misc Payer Copy C Item 5112

Nec5112b 2 Up 1099 Nec Laser Payer State Copy C Tax Forms In Bulk Packs With Nec Non Employee Compensation New

Form 1099 Nec What Does It Mean For Your Business

Why Do Hoas Need To File Form 1099 Misc Clark Simson Miller

Tax Formspack Pre Designed Suite Of Tax Documents Quadrant Software

1099 Software User Guide Note This Is Intended To Be A General Guide To Introduce You To The Ftwilliam Com 1099 Software Features And Structure More Details Are Often Provided At Ftwilliam Com And Through Free Webinars Preformed Throughout The Year At

Sample 1099 Misc Forms Printed Ezw2 Software

21 Laser 1099 Int Income Federal Copy A Deluxe Com

What Is Form 1099 Nec Who Uses It What To Include More

Businesses Get Ready For The New Form 1099 Nec Hw Co

Tax Form 1099 Nec Copy B Recipient Nec5111 Mines Press

1099 Misc Payer State Copy 1

Amazon Com Egp 1099 Misc Recipient Copy B Irs Approved Laser Quantity 1000 Forms Recipients 500 Sheets 1 Carton Office Products

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

1099 Nec Copy C 2 Laser Form 50 Sheet Pack Neclmc2 8 14 Monarch Accounting Supplies For All Your Accounting Tax Form Needs

All You Need To Know About Form 1099 Misc Alfano Company Llc

1099 Misc Tax Form Pressure Seal W 2taxforms Com

3

19 1099 Misc 1096 Irs Copy A Form Print Template For Word Etsy

1099 Nec Federal Copy A Cut Sheet Hrdirect

Ready For The 1099 Nec

Businesses Have Feb 1 Deadline To Provide Forms 1099 Misc And 1099 Nec To Recipients Mychesco

1099 Misc Miscellaneous Income Payer State Copy 1 2up

Amazon Com Egp 1099 Misc Recipient Copy B Irs Approved Laser Quantity 1000 Forms Recipients 500 Sheets 1 Carton Office Products

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Tf5141 Laser 1099 R Copy B 8 1 2 X 11

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Nec Software Software To Create Print And E File Form 1099 Nec

Form 1099 Nec Instructions And Tax Reporting Guide

Nagforms Laser 1099 Nec Payer State Copy C 100 Pk Neclmc

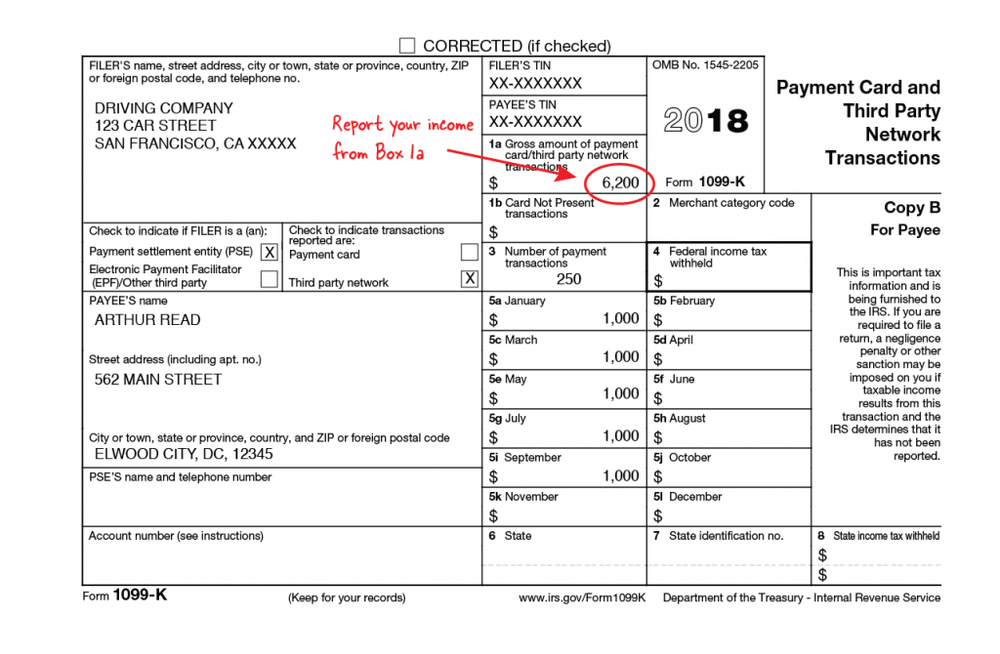

What Is A 1099 K Stride Blog

Where Is My 1099 Atbs

1099 Nec Form 22 1099 Forms Taxuni

1099 Misc Copy C State Laser W 2taxforms Com

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Misc Miscellaneous Payer State Copy C Cut Sheet 400 Forms Pack

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

1099 Int 2up Interest Income Copy 1 Payer State Bint105

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

0 件のコメント:

コメントを投稿